India’s Forex Reserves hits $605 billion for the First Time.

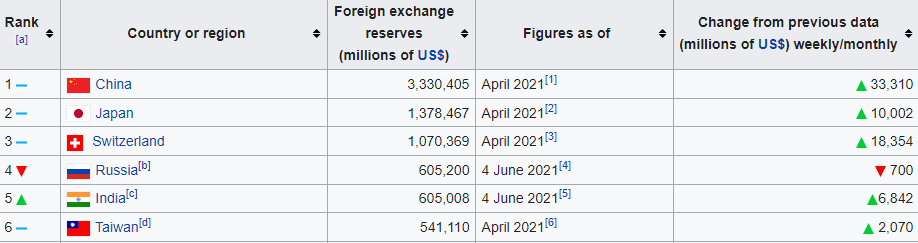

At $605 billion, India ties with Russia as fourth largest forex reserves holder.

Scoring at 5th position, tie with Russia, as always China taking at first position with 3.3 trillion dollar forex reserves reserves, with the help of this forex reserves China provides huge loan to other economically week countries and trap them into their ‘debt trap’.

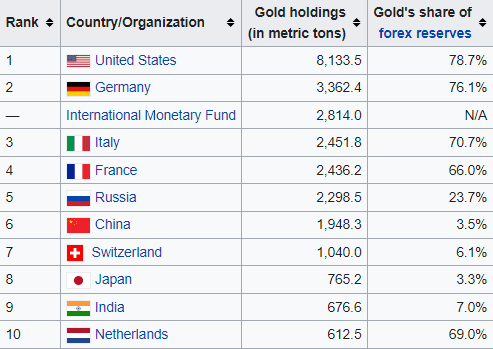

This is surprising that America had 21st position in the forex reserves, this is due to all of the top five forex reserves country have their reserves in the format of dollar instead USA believes in Big future investments like gold which is going to be higher in value as the time passes.

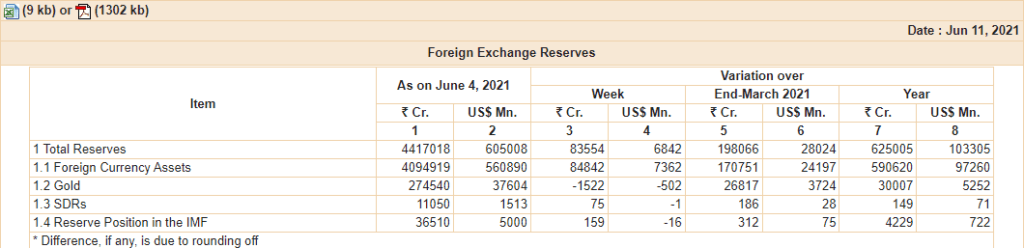

This is surprising for India because 30 years ago India had biggest economic crisis at that time India had 3 billion dollar as forex reserves but now India has jumped to $605 billion forex reserves. This is all due to great industrialization in India and biggest efforts led by our RBI.

However this is so surprising because our GDP is in negative quarter from one and half years, which implies in our country other countries had started investing their money and started their business.

The major reason for the rise in forex reserves is the rise in investment in foreign portfolio investors in Indian stocks and foreign direct investment (FDI), foreign investment had acquired stakes in serval Indian companies in last 2 months.

In the recent reports India had received record of $81.7 billion dollar investment through foreign direct investment (FDI) in 2021.

India’s April 2021 exports triple from the last year trade deficit at $15.10 billion.

Which implies foreign investors still believes that will have huge Economic Rise in upcoming years.

Foreign-exchange reserves (also called Forex reserves) are, in a strict sense, only foreign-currency deposits held by national central banks and monetary authorities (See List of countries by foreign-exchange reserves (excluding gold)). However, in popular usage and in the list below, it also includes gold reserves, special drawing rights (SDRs) and International Monetary Fund (IMF) reserve position because this total figure, which is usually more accurately termed as official reserves or international reserves or official international reserves, is more readily available and also arguably more meaningful.

These foreign-currency deposits are the financial assets of the central banks and monetary authorities that are held in different reserve currencies (e.g. the U.S. dollar, the Euro, the Japanese Yen, Swiss Franc, Chinese Yuan, and the Pound Sterling) and which are used to back its liabilities (e.g. the local currency issued and the various bank reserves deposited with the Central bank by the government or financial institutions). Before the end of the gold standard, gold was the preferred reserve currency. Some nations are converting foreign-exchange reserves into sovereign wealth funds, which can rival foreign-exchange reserves in size.

The list below is mostly based on the latest available IMF data, and while most nations report in U.S. dollars, a few nations in Eastern Europe report solely in Euros. And since all the figures below are in U.S. dollar equivalents, exchange rate fluctuations can have a significant impact on these figures.

Read Also: Belt and Road Initiative of China (BRI) is getting bigger & stronger?

China refuses loan to Pakistan for Power purchase.

Bankrupt Pakistan’s dept problem seems to be escalating as it is weather-ally China has declined to restructure USD 3 billion in liabilities. Islamabad has requested Beijing to forget debt liabilities owed to China funded energy projects established under the China Pakistan Economic Corridor(CPEC).

Finally Donald Trump demands 10$ trillion from China, Trump believes Covid-19 was Leaked from China’s Wuhan Lab.

China blames Britain for Bloodshed in Kashmir, Quoting a Xinhua Report.